The way the roll out of how HUD was going to allow the use of the tax credit as a down payment prompted me to joke that Gilligan was going to be the next Secretary of HUD and The Skipper would be put at the helm of FHA. While I still maintain that HUD is a dysfunctional bureaucracy it is refreshing to see that someone(s) in there realized that a free for all use of these funds was not a good idea.

Here's the link to HUD's website, read the mortgagee letter for yourself, you will see that this alleged final version is quite a distance from Sec. Donavan's announcement to the NAR a couple of weeks ago; http://www.hud.gov/offices/adm/hudclips/letters/mortgagee/files/09-15ml.doc .

News media and other bloggers, me included, are all over this announcement. I want to thank Dan Allen ( http://theallenteam.yourkwagent.com/ ) at Keller Williams Mid Willamette for the tip early Friday morning on this.

The one thing that everyone needs to know is that the borrower will still need to come to the table with the minimum 3.5% down. This credit cannot be used to get a borrower to 100% financing, oh thank goodness. There are a specific set of conditions that need to be followed in connection with this credit. In order to make these funds available at the close of escrow the tax credit has to be monetized. So the borrower will need to take out a second lien or "sell" their tax credit in order to use the funds.

So who is going to carry the second lien? Who can a borrower sell their credit to to get at this money? Good questions, that don't have answers yet, these are certainly not addressed in the mortgagee letter. All the policy announcement states are the conditions under which it can be done. It's these two questions that will determine how long it will be before this is actually implemented by lenders...my guess, 4 to 6 weeks before lenders get this all figured out.

One other item to note. Just because this policy is out doesn't mean every non profit, governmental agency or lender has to participate. And, although 17 states have or are working on implementing this doesn't mean the other 33 states will. Neighborhood Housing entities run by municipalities and established non profits will be the only source of accurate information on this that I would rely on. For now, watch for the scammers there is plenty of money to be made off of people that won't understand what this policy is all about. The usual suspects in my market area ( LOs that have already marketed this, you know who you are ) are making this sound like it needs to be done today. As in Part 1 of this series, I say wait for it. You won't be disappointed.

Saturday, May 30, 2009

Thursday, May 28, 2009

Appraisals, Appraisal Reviews and the New World Order of Closing a Deal

Several closed loans and many conversations with RE agents got me to thinking ( Thanks specifically to Ric Vega, http://ricvega.com/ and Don Bartley at Keller Williams Mid Willamette) about how most buyers have dealt with the issue of appraised value in a RE deal. In the past, borrowers of mine have followed the same pattern: 1, gets an offer accepted, 2, has "x" number of days to complete inspections, 3, negotiates any issue(s) that come up and then, 4, orders the appraisal. The logic was, why spend money on an appraisal if the deal was going to die because the house was a piece of crap. Appraisal gets done, value is at, above or just a wee under sales price...done, buyer has a new home.

Fast forward to 2009. Lenders are bashing on the one last thing that is available, the collateral. In order to be able to sell loans on the secondary market ( or even have the option to at a later time ) lenders must be able to say with more surety than ever that the loans they are doing will not go bad. The pressure on lenders to do their due diligence on a loan is more extreme than many may realize. This is nothing as obvious as qualifying a borrower on income, assets and credit history. Those restrictions, while frustrating to all those who participated in a deal facilitated by a stated income loan in the past, are going to be nothing compared to this. I would suggest we all come to grips really, really soon with the terms "Insufficient Collateral" or "Reduced Value".

Examples? Sure; a re finance client from another lender with 800 FICO scores, a 9% debt to income ratio and 85 months of payment reserves denied on a 50% loan to value transaction. This is what was known as a "make sense" deal. Not any more. A comment by the borrower was, " They wouldn't do a loan for me because they said they wouldn't be able to sell my property when they foreclosed on us. We are never going to miss payment!" A value reduced 15% by a review appraiser from the original value. Used 2 of the same comps but reduced the value of the subject by $5000 because it had a less superior view, both properties are in a residential neighborhood. Did the comp have a view of the neighbor ladies changing room? That could be construed as a superior view by some, but I don't know that it's worth 5 grand.

From my perspective we are seeing another manipulation of values. One that may do more harm than good. The first one, the restrictions on borrower credit, was in reality a very reasonable step to take. But now we are seeing the restriction of credit based on automated criteria in computer models for the valuation of a subject property. The use of Automated Valuation Models is the primary determinant if an appraised value will be subject to additional review. All by itself this has the potential to drive values even farther down than they would fall as a result of normal market forces. It's another vicious cycle that could kill a lot of deals late in the game. The issue will now be that sales transactions will be more likely to fail due to appraisal issues rather than inspection ones.

The reliance on AVMs is understandable, on the surface anyway. Taking the human element out of the valuation process removes any possibility of fraud or other nasty bad things that could happen. These systems are likely to be very robust in their analysis. After all, automated underwriting systems have made all approved loans non defaultable, right? But as with all computer models, garbage in, garbage out. In states where sales prices do not have to be recorded accurately ( or at all ) the quality of the information is at best suspect. Yet, lenders AND investors in mortgages rely on AVMs to quantify the risk associated with a particular property's value. I have argued, successfully and unsuccessfully against their use. For now, the battle continues.

My solution is to suggest the reversal in the order of inspection / appraisal regimen. The borrower should order the appraisal first, see if any value issues arise that may cause them to renegotiate or walk away from their contract, then order the inspection. After all, the appraiser will note any grossly obvious defects in the home that the inspection will no doubt flesh out. For the seller, well you guys are pretty well hosed right now, whether you think so or not. May as well get the really bad stuff out of the way early. Any seller that thinks they can dig their heals in on "their" price better take a look around and have their listing agent to give it to them straight. The first offer you get will be the best and highest one you will get, better take it and hope the borrower's lender doesn't come in and make your listing agent's CMA look like doody.

Fast forward to 2009. Lenders are bashing on the one last thing that is available, the collateral. In order to be able to sell loans on the secondary market ( or even have the option to at a later time ) lenders must be able to say with more surety than ever that the loans they are doing will not go bad. The pressure on lenders to do their due diligence on a loan is more extreme than many may realize. This is nothing as obvious as qualifying a borrower on income, assets and credit history. Those restrictions, while frustrating to all those who participated in a deal facilitated by a stated income loan in the past, are going to be nothing compared to this. I would suggest we all come to grips really, really soon with the terms "Insufficient Collateral" or "Reduced Value".

Examples? Sure; a re finance client from another lender with 800 FICO scores, a 9% debt to income ratio and 85 months of payment reserves denied on a 50% loan to value transaction. This is what was known as a "make sense" deal. Not any more. A comment by the borrower was, " They wouldn't do a loan for me because they said they wouldn't be able to sell my property when they foreclosed on us. We are never going to miss payment!" A value reduced 15% by a review appraiser from the original value. Used 2 of the same comps but reduced the value of the subject by $5000 because it had a less superior view, both properties are in a residential neighborhood. Did the comp have a view of the neighbor ladies changing room? That could be construed as a superior view by some, but I don't know that it's worth 5 grand.

From my perspective we are seeing another manipulation of values. One that may do more harm than good. The first one, the restrictions on borrower credit, was in reality a very reasonable step to take. But now we are seeing the restriction of credit based on automated criteria in computer models for the valuation of a subject property. The use of Automated Valuation Models is the primary determinant if an appraised value will be subject to additional review. All by itself this has the potential to drive values even farther down than they would fall as a result of normal market forces. It's another vicious cycle that could kill a lot of deals late in the game. The issue will now be that sales transactions will be more likely to fail due to appraisal issues rather than inspection ones.

The reliance on AVMs is understandable, on the surface anyway. Taking the human element out of the valuation process removes any possibility of fraud or other nasty bad things that could happen. These systems are likely to be very robust in their analysis. After all, automated underwriting systems have made all approved loans non defaultable, right? But as with all computer models, garbage in, garbage out. In states where sales prices do not have to be recorded accurately ( or at all ) the quality of the information is at best suspect. Yet, lenders AND investors in mortgages rely on AVMs to quantify the risk associated with a particular property's value. I have argued, successfully and unsuccessfully against their use. For now, the battle continues.

My solution is to suggest the reversal in the order of inspection / appraisal regimen. The borrower should order the appraisal first, see if any value issues arise that may cause them to renegotiate or walk away from their contract, then order the inspection. After all, the appraiser will note any grossly obvious defects in the home that the inspection will no doubt flesh out. For the seller, well you guys are pretty well hosed right now, whether you think so or not. May as well get the really bad stuff out of the way early. Any seller that thinks they can dig their heals in on "their" price better take a look around and have their listing agent to give it to them straight. The first offer you get will be the best and highest one you will get, better take it and hope the borrower's lender doesn't come in and make your listing agent's CMA look like doody.

Thursday, May 21, 2009

Tax Credit as a down payment part 4...An alternative announcement from HUD

The same reporter from the Arizona Republic that was the source for my post on Tuesday has updated his article! Not really sure how the guy was able to publish an article that wasn't fact checked by his editor before it was published is a different subject altogether.

What a load. If HUD can't even manage the announcements relating to this fairly significant policy change how can we expect that the entire thing will actually be thought through. Mortgagee Letter 09-15 should have never been released.

Maybe this could be used as an alternative announcement:

Attention all first time home buyers..

We, at HUD, really want to help you out when you buy your first home. We really, really do. In an effort to stimulate the housing market, despite the consequences, we have decided to bow to all the lobbying efforts of the home builders and the NAR.

Starting June 1, 2009 all you need to do is call us at 1-800-GET- CASH. Tell us why you think we should send you tax payer money and you will get a check, it's that easy.

We figure we have lost so much money already a few extra billion won't be too hard to explain. Of course, if you would like to make a donation to our cause please call 1-800-VACUUM. We accept donations in all currencies except US $'s.

I completely understand the motivation for the first and second versions of the 1st time buyer's credits. From my perspective it has gone as advertised. Personally, I have seen more interest from 1st timers since late 2008 than I had in the past 4 years in the business. I don't specifically market to that segment, so for me to have an uptick says that it was working.

As it is right now the program makes sense. Put a little skin in the game now, get a nice little nut from Uncle Sam next April. It is an established fact, when people put their own money into a deal they are less likely to default on a loan. Did I mention that the existing program works?

The housing market is still experiencing pain, OK mostly the sellers. It is called a business cycle for a reason, we cycle up AND down. I am really confused why there are attempts to bring the market back to a place that is even in the vicinity of where we were a year and a half ago. There are a number of people suffering from the effects of it now.

Simply put what we have going on now is an effort to manipulate the RE market by HUD. I don't think we need it.

What a load. If HUD can't even manage the announcements relating to this fairly significant policy change how can we expect that the entire thing will actually be thought through. Mortgagee Letter 09-15 should have never been released.

Maybe this could be used as an alternative announcement:

Attention all first time home buyers..

We, at HUD, really want to help you out when you buy your first home. We really, really do. In an effort to stimulate the housing market, despite the consequences, we have decided to bow to all the lobbying efforts of the home builders and the NAR.

Starting June 1, 2009 all you need to do is call us at 1-800-GET- CASH. Tell us why you think we should send you tax payer money and you will get a check, it's that easy.

We figure we have lost so much money already a few extra billion won't be too hard to explain. Of course, if you would like to make a donation to our cause please call 1-800-VACUUM. We accept donations in all currencies except US $'s.

I completely understand the motivation for the first and second versions of the 1st time buyer's credits. From my perspective it has gone as advertised. Personally, I have seen more interest from 1st timers since late 2008 than I had in the past 4 years in the business. I don't specifically market to that segment, so for me to have an uptick says that it was working.

As it is right now the program makes sense. Put a little skin in the game now, get a nice little nut from Uncle Sam next April. It is an established fact, when people put their own money into a deal they are less likely to default on a loan. Did I mention that the existing program works?

The housing market is still experiencing pain, OK mostly the sellers. It is called a business cycle for a reason, we cycle up AND down. I am really confused why there are attempts to bring the market back to a place that is even in the vicinity of where we were a year and a half ago. There are a number of people suffering from the effects of it now.

Simply put what we have going on now is an effort to manipulate the RE market by HUD. I don't think we need it.

Tuesday, May 19, 2009

Bye Bye Tax credit Down Payment..Sanity Rules at FHA?

Under the heading of something that was too good to be true:

Tax credit ineligible for down payment

Feds reverse rule to assist first-time home buyers

by J. Craig Anderson - May. 19, 2009 12:00 AM The Arizona Republic

Federal officials on Monday reversed an earlier decision to allow first-time home buyers to use an $8,000 tax credit to borrow the down payment on a home.

A week earlier, U.S. Department of Housing and Urban Development Secretary Shaun Donovan had told the National Association of Home Builders that HUD would let banks and local governments offer short-term "bridge loans" to cover the down payment for first-time buyers eligible for the tax credit. The loans would have been available to applicants for federally insured mortgages such as Federal Housing Administration loans.

Lenders, home builders and real- estate agents had reacted favorably to the bridge-loan proposal, saying it would open up the housing market to more first-time buyers.

However, not everyone was in favor of using the tax credit as collateral on a down-payment loan.

"That tax credit should be savings, not debt," said Patricia Garcia-Duarte, executive director of Neighborhood Housing Services in Phoenix.

Garcia-Duarte said the proposal too closely resembled a now-illegal practice known as seller-funded down-payment assistance, which allowed a home's seller to "gift" the down payment to a specific buyer through a non-profit organization.

The loans also could have created income-tax issues, according to the IRS officials who shot down HUD's plan.

Well, well what a surprise! At least there are some sane decisions being made at FHA. So let's recap who wanted this..

Builders....check! Gotta get rid of that pesky inventory that is costing them interest payments every month

RE Agents..check! Gotta get after those first timers 'cause nobody else is even looking in some markets.

Lenders.. how about we change that to LOs looking to make a score. Some that still haven't figured out how to do a loan that isn't stated. Certainly not this one and many others that actually thought this through ( see my post from last week). I redacted part of the post that announced this. There is a quote from an LO that pointed out what I have, it was a bad idea, a very bad idea.

Bridge loan, too funny. First timers are the least educated group of buyers out there and most often need to be walked through the whole process. Not only does the whole process of buying a home look like smoke and mirrors, the lending side can put them down for the count if they don't have someone looking out for their interests.Throw something like this at them and we were headed for disaster.

The whole situation now kind of reminds me of a scene in the first Naked Gun movie. "Move along, there's nothing to see here people. "

Tax credit ineligible for down payment

Feds reverse rule to assist first-time home buyers

by J. Craig Anderson - May. 19, 2009 12:00 AM The Arizona Republic

Federal officials on Monday reversed an earlier decision to allow first-time home buyers to use an $8,000 tax credit to borrow the down payment on a home.

A week earlier, U.S. Department of Housing and Urban Development Secretary Shaun Donovan had told the National Association of Home Builders that HUD would let banks and local governments offer short-term "bridge loans" to cover the down payment for first-time buyers eligible for the tax credit. The loans would have been available to applicants for federally insured mortgages such as Federal Housing Administration loans.

Lenders, home builders and real- estate agents had reacted favorably to the bridge-loan proposal, saying it would open up the housing market to more first-time buyers.

However, not everyone was in favor of using the tax credit as collateral on a down-payment loan.

"That tax credit should be savings, not debt," said Patricia Garcia-Duarte, executive director of Neighborhood Housing Services in Phoenix.

Garcia-Duarte said the proposal too closely resembled a now-illegal practice known as seller-funded down-payment assistance, which allowed a home's seller to "gift" the down payment to a specific buyer through a non-profit organization.

The loans also could have created income-tax issues, according to the IRS officials who shot down HUD's plan.

Well, well what a surprise! At least there are some sane decisions being made at FHA. So let's recap who wanted this..

Builders....check! Gotta get rid of that pesky inventory that is costing them interest payments every month

RE Agents..check! Gotta get after those first timers 'cause nobody else is even looking in some markets.

Lenders.. how about we change that to LOs looking to make a score. Some that still haven't figured out how to do a loan that isn't stated. Certainly not this one and many others that actually thought this through ( see my post from last week). I redacted part of the post that announced this. There is a quote from an LO that pointed out what I have, it was a bad idea, a very bad idea.

Bridge loan, too funny. First timers are the least educated group of buyers out there and most often need to be walked through the whole process. Not only does the whole process of buying a home look like smoke and mirrors, the lending side can put them down for the count if they don't have someone looking out for their interests.Throw something like this at them and we were headed for disaster.

The whole situation now kind of reminds me of a scene in the first Naked Gun movie. "Move along, there's nothing to see here people. "

Wednesday, May 13, 2009

Well that didn't take long! Document for FHA down payment removed

HUD "Pulls" Mortgagee Letter on Tax Credit

The Letter 09-15, the document that addressed the use of the tax credit as a down payment for FHA loans has been pulled from HUD.gov.

Maybe it doesn't mean anything but the guideline brief that had been posted on HUD.gov is no longer available.

Looks like my advice from today's earlier post was fairly accurate. Wait and see what comes of the new policy.

The Letter 09-15, the document that addressed the use of the tax credit as a down payment for FHA loans has been pulled from HUD.gov.

Maybe it doesn't mean anything but the guideline brief that had been posted on HUD.gov is no longer available.

Looks like my advice from today's earlier post was fairly accurate. Wait and see what comes of the new policy.

First Time Homebuyer Credit as a Down Payment..Uncle Sam to RE's rescue

Here's the latest assist from the Federal Government for the real estate market.:

US Department of Housing and Urban Development secretary Shaun Donovan made the announcement yesterday. Donovan’s announcement came at a National Association of Realtors legislative summit, although HUD’s details on the initiative aren’t scheduled for official release until next week. The initiative will allow FHA-approved lenders to monetize the tax credit through short-term bridge loans, letting borrowers access the funds at the closing table.

OK, this sounds really awesome. The web is filled with the expected amount of hyporama on this development. There are no official releases until next week from HUD. What will likely follow is another 2 to 4 week period for all the lenders to figure out how to implement the new policy. I will say it again, there are no official releases until next week.

I have, and anyone in RE, should have some questions and concerns on this new policy. I am not suggesting I am against it, after all I work for a FHA approved lender, but let's take a look at some potential issues that come to mind.

Will a lien be placed on the property at close of escrow? Will it be an IRS lien ( it is a TAX credit ) or will it be a FHA lien similar to ones we see from community non profits that provide buyers credits?

How will the bridge loan be repaid? If all goes well the borrower will have the full credit coming back to them when they do their taxes for 2009. But what happens if the borrower ends up owing taxes? Will the IRS place a lien on the borrower and/or property? Lenders don't like IRS liens, either do title companies.

Is the bridge loan payable in full in the next tax cycle? Or can it be paid back over time like the original $7500 tax credit?

Is it a lien that stays on the property until it is sold?

For the government conspiracy theorists; If the government has a lien on my house can they tell me what I can or can't do to the home?

Agents, better get your addenda forms out 'cause you will be using them. Is the use of the credit determined by the date of the contract for purchase or the potential funding date? I'll bet there will be a shipload of contract extensions done in the next few days.

Questions, lot's of them are not listed here.

So the hype is upon us. But what the hell, who cares about the ramifications, let's just go out and mine our databases for first time home buyers ( like we weren't already! ). I took 15 phone calls on this in the first hour and 15 minutes in the office this morning. I say let's chill out for a bit and get our bearings.

I am contacting my first timers with one piece of advice. Don't do anything, yet. Just like all the other changes we have seen mandated by new government programs in the last few months this not a policy that will be implemented overnight. What I am telling them is the the same advice I give to all buyers, first timers or no.

1) Get your financials together ( 2-2-2 Rule, 2 months pay stubs, 2 months bank statements, 2 years tax returns )

2) Make an appointment with your favorite lender.

3) have them pre approve you in either FNMA's DU or FHLMC's LP.

4) Wait for everything to come out in the wash.

There will be no prize for being the first one to do this. What I will say is don't wait until October to do this. Unless the rules change this credit goes away December 1. If you don't close by November 30 you will have missed the boat.

US Department of Housing and Urban Development secretary Shaun Donovan made the announcement yesterday. Donovan’s announcement came at a National Association of Realtors legislative summit, although HUD’s details on the initiative aren’t scheduled for official release until next week. The initiative will allow FHA-approved lenders to monetize the tax credit through short-term bridge loans, letting borrowers access the funds at the closing table.

OK, this sounds really awesome. The web is filled with the expected amount of hyporama on this development. There are no official releases until next week from HUD. What will likely follow is another 2 to 4 week period for all the lenders to figure out how to implement the new policy. I will say it again, there are no official releases until next week.

I have, and anyone in RE, should have some questions and concerns on this new policy. I am not suggesting I am against it, after all I work for a FHA approved lender, but let's take a look at some potential issues that come to mind.

Will a lien be placed on the property at close of escrow? Will it be an IRS lien ( it is a TAX credit ) or will it be a FHA lien similar to ones we see from community non profits that provide buyers credits?

How will the bridge loan be repaid? If all goes well the borrower will have the full credit coming back to them when they do their taxes for 2009. But what happens if the borrower ends up owing taxes? Will the IRS place a lien on the borrower and/or property? Lenders don't like IRS liens, either do title companies.

Is the bridge loan payable in full in the next tax cycle? Or can it be paid back over time like the original $7500 tax credit?

Is it a lien that stays on the property until it is sold?

For the government conspiracy theorists; If the government has a lien on my house can they tell me what I can or can't do to the home?

Agents, better get your addenda forms out 'cause you will be using them. Is the use of the credit determined by the date of the contract for purchase or the potential funding date? I'll bet there will be a shipload of contract extensions done in the next few days.

Questions, lot's of them are not listed here.

So the hype is upon us. But what the hell, who cares about the ramifications, let's just go out and mine our databases for first time home buyers ( like we weren't already! ). I took 15 phone calls on this in the first hour and 15 minutes in the office this morning. I say let's chill out for a bit and get our bearings.

I am contacting my first timers with one piece of advice. Don't do anything, yet. Just like all the other changes we have seen mandated by new government programs in the last few months this not a policy that will be implemented overnight. What I am telling them is the the same advice I give to all buyers, first timers or no.

1) Get your financials together ( 2-2-2 Rule, 2 months pay stubs, 2 months bank statements, 2 years tax returns )

2) Make an appointment with your favorite lender.

3) have them pre approve you in either FNMA's DU or FHLMC's LP.

4) Wait for everything to come out in the wash.

There will be no prize for being the first one to do this. What I will say is don't wait until October to do this. Unless the rules change this credit goes away December 1. If you don't close by November 30 you will have missed the boat.

Sunday, May 10, 2009

100% Loans for Everyone...Not so fast Mister

Even in today's environment we can still find Loan Officers pitching the miracle of no money down loan programs. In some cases they are assisted by a Title/Escrow company or a Realtor in putting together a "class" on how to take advantage of these programs. There are 100% LTV programs but these loans are not for everyone. So why pitch these programs? Let's call a spade a spade. Those touting these loans are really only on a big fishing expedition for potential buyers. Some that probably shouldn't be buying in the first place.

So what is really left out there for a borrower with no money of their own? 2 programs..VA and USDA Rural Housing. For everyone? Not exactly. As I have noted to some, these 2 programs are for specific subsets of all potential borrowers.

VA? Gotta be a vet or a qualifying widow of one. USDA? Can't make too much money and you must buy a home either in the country or in a town of less than 20,000 people. On top of those entry requirements the debt to income ( DTI ) restrictions are such that not even all the potential qualifiers are eligible. The VA makes sure the vet can not only afford the house payment but the utilities and food and clothing for the family. USDA has DTI restrictions as well. No wonder these programs have the lowest default rates of any loan programs..ever.

RE agents love any loan that can get a buyer into a home. Title and Escrow companies do too. The reason is simple, close a deal..get paid. To be fair a loan officer's mentality is pretty much the same. We don't get paid until a deal is closed either. The issue is that we as loan officers have an ethical, fiduciary responsibility to the borrower that far exceeds any that an RE agent has.

The loan officer is the only person in a position to inform the borrower of their choices AND the consequences of them. We have a responsibility to say, "wait a minute, is this really what you want to do?" We are the only ones that have a complete understanding of a borrower's financial state. We are the ones that know what they can truly afford. We are the ones that, if we are asking the questions we are supposed to, know how their household budget stands. We are the guardians of their financial future.

So why do I have a problem with pitching 100% loan programs to everyone? Because it puts a borrower into a position where emotion ( the desire to have the American dream ) can override logic. Who doesn't want to own a home? But it is an established fact that borrowers that don't have their own skin into the game are more likely to default on a loan. Need an example? One of the reasons that FHA no longer allows a seller to "contribute" ( through a sham of convolution using "non profit" entities ) the buyers down payment any longer is because borrowers using seller contributed down payment defaulted on their loans 3 1/2 times more frequently than borrowers with their own funds...nuff said.

So the question is, do we as an industry continue along the path that got us where we are today, giving anyone that wanted to buy a loan? Or do we have enough guts to say to a potential buyer, "maybe you should wait" or "let's look at something more reasonably priced for you"?

I know where I stand. I would prefer to advise a client to wait if it is appropriate for their situation. What do you think?

So what is really left out there for a borrower with no money of their own? 2 programs..VA and USDA Rural Housing. For everyone? Not exactly. As I have noted to some, these 2 programs are for specific subsets of all potential borrowers.

VA? Gotta be a vet or a qualifying widow of one. USDA? Can't make too much money and you must buy a home either in the country or in a town of less than 20,000 people. On top of those entry requirements the debt to income ( DTI ) restrictions are such that not even all the potential qualifiers are eligible. The VA makes sure the vet can not only afford the house payment but the utilities and food and clothing for the family. USDA has DTI restrictions as well. No wonder these programs have the lowest default rates of any loan programs..ever.

RE agents love any loan that can get a buyer into a home. Title and Escrow companies do too. The reason is simple, close a deal..get paid. To be fair a loan officer's mentality is pretty much the same. We don't get paid until a deal is closed either. The issue is that we as loan officers have an ethical, fiduciary responsibility to the borrower that far exceeds any that an RE agent has.

The loan officer is the only person in a position to inform the borrower of their choices AND the consequences of them. We have a responsibility to say, "wait a minute, is this really what you want to do?" We are the only ones that have a complete understanding of a borrower's financial state. We are the ones that know what they can truly afford. We are the ones that, if we are asking the questions we are supposed to, know how their household budget stands. We are the guardians of their financial future.

So why do I have a problem with pitching 100% loan programs to everyone? Because it puts a borrower into a position where emotion ( the desire to have the American dream ) can override logic. Who doesn't want to own a home? But it is an established fact that borrowers that don't have their own skin into the game are more likely to default on a loan. Need an example? One of the reasons that FHA no longer allows a seller to "contribute" ( through a sham of convolution using "non profit" entities ) the buyers down payment any longer is because borrowers using seller contributed down payment defaulted on their loans 3 1/2 times more frequently than borrowers with their own funds...nuff said.

So the question is, do we as an industry continue along the path that got us where we are today, giving anyone that wanted to buy a loan? Or do we have enough guts to say to a potential buyer, "maybe you should wait" or "let's look at something more reasonably priced for you"?

I know where I stand. I would prefer to advise a client to wait if it is appropriate for their situation. What do you think?

Tuesday, May 5, 2009

The Bloggers on the left side of the Page

In an effort to fill space and provide a little insight I thought I would share what I like about the blogs and websites I have posted for recommended reading.

Calculated Risk - http://www.calculatedriskblog.com/Once two contributors, now one due to the passing of Tanta. She would have been someone I would have loved to meet in person. Th's blog is a awesome catch all for all things geeky in the financial sector. Great graphs and very easy to understand explanations of banking and finance. Usually updated multiple times a day.

Truth about Mortgage.com -http://www.thetruthaboutmortgage.com/ Short posts on the "topics" of the moment as the author sees fit. This site has been a site I look to for precise and condensed versions of longer articles in other publications. More times than I can count articles from this site have led me on wonderful searches to other sites and traditional news sources. Plus every story has a pic, bonus.

Market Ticker - http://market-ticker.denninger.net/ Karl Denniger was one of my early blog heroes, still is. Unfortunately he has definitely moved on from his original raison d'etre. That of giving readers insight into his very brilliant mind on the trading of options to one that is definitely more political. He definitely will call out less than intelligent congressmen and politicians. Don't agree with about 70% of the stuff he says but I still respect his opinion. His website has a traders forum that is never boring.

Paul Krugman - http://krugman.blogs.nytimes.com/ New York Times columnist, Econmist, Nobel Prize Winner. "Nuff said. To my recollection he has not been wrong about what has happened to our economy, yet. Not that I would put Karl Denniger and Mr. Krugman in the same club but they do offer a nice counter to each others opinions.

Calculated Risk - http://www.calculatedriskblog.com/Once two contributors, now one due to the passing of Tanta. She would have been someone I would have loved to meet in person. Th's blog is a awesome catch all for all things geeky in the financial sector. Great graphs and very easy to understand explanations of banking and finance. Usually updated multiple times a day.

Truth about Mortgage.com -http://www.thetruthaboutmortgage.com/ Short posts on the "topics" of the moment as the author sees fit. This site has been a site I look to for precise and condensed versions of longer articles in other publications. More times than I can count articles from this site have led me on wonderful searches to other sites and traditional news sources. Plus every story has a pic, bonus.

Market Ticker - http://market-ticker.denninger.net/ Karl Denniger was one of my early blog heroes, still is. Unfortunately he has definitely moved on from his original raison d'etre. That of giving readers insight into his very brilliant mind on the trading of options to one that is definitely more political. He definitely will call out less than intelligent congressmen and politicians. Don't agree with about 70% of the stuff he says but I still respect his opinion. His website has a traders forum that is never boring.

Paul Krugman - http://krugman.blogs.nytimes.com/ New York Times columnist, Econmist, Nobel Prize Winner. "Nuff said. To my recollection he has not been wrong about what has happened to our economy, yet. Not that I would put Karl Denniger and Mr. Krugman in the same club but they do offer a nice counter to each others opinions.

Sunday, May 3, 2009

Western Oregon Home Price Declines

An enlightening series of articles in the Eugene Register-Guard by Diane Dietz today ( http://www.registerguard.com/csp/cms/sites/web/news/cityregion/12247988-57/story.csp ). While the reporter has the tendency to run a little light in the facts and analysis categories on these types of articles, 2 of the 3 at least give everyone in this part of Oregon a heads up on what is coming to our little corner of the world. The articles got me to thinking...

For the last 18 months my belief has been we will see default and foreclosures rates mirror those in other parts of the country. Our only defense could very well be that we did not have the massive annual appreciations other markets around us experienced. But that is no guarantee that our coming depreciation rates will be any less than other markets. A "market correction's" behavior is not dependent on the market's run up profile.

For some there has been a sense of denial that what is happening everywhere else in the country, or even the state, could not possibly happen here. Statements like; "our job base is more stable", "home buyers in our market are more educated", "it is a more desirable place to live", etc., are still being used as if they were a vaccination against the potentially viral market down turn seen in nearly every market in the US.

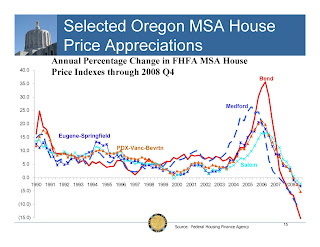

Here is a chart from Tom Potiowski, State of Oregon Economist.

All around Oregon, we have seen what is occurring in the rest of the country. Portland, Salem, Medford, and especially Bend; have all experienced downward price trends and the associated rise in mortgage defaults and foreclosures. Albany and Lebanon are not immune, and, Eugene and Springfield are in the club as well. What makes some think it won't happen here in Corvallis? In reality it has already been happening. So far, depreciation has been smaller than other markets. But it's happening and the facts suggest that it will get worse before it gets better.

All the data shows that the peak in price appreciations in California occurred in the middle of 2004. California's rate of depreciation just bottomed out ( a false bottom? ) in early 2009. A 4 1/2 year cycle. Oregon as a whole didn't have that same peak until late 2006. That means we potentially have another 2 years to go, yikes!

Here's why I think we have yet to see the bottom. 1) job losses across all industries in the area continue to mount, 2) one of the largest employers in our area continues to lay off or transfer employees out of the area, 3) the over blown belief that it is impossible to get a loan to buy a home, and , 4) that pesky issue of shadow inventory of un listed homes owned by banks, Fannie Mae and Freddie Mac. For the record, #3 is just not true. It's called qualifying for a payment that you can afford.

Who should be buying in this market? Probably not cash buyers. We will see these folks sit on the sidelines for a bit longer. There might be blood in the water but not enough for them yet. But those thinking of buying in the next year that will be borrowing money shouldn't wait much longer. Mortgage rates are as low as they are going to get despite what an Internet site or an unscrupulous broker may tell you. The fact is the impending increase in rates will more than wipe out any additional declines in values by several factors. And that discussion is for a different post.

Subscribe to:

Posts (Atom)